Financial Planning News and Insights

The latest news and views from Apt Wealth

From superannuation and retirement to investments and planning for life events and milestones, our team shares expert insights on common financial planning questions.

As always, please contact us for personalised advice that takes into account your circumstances and goals.

CATEGORIES

- All 543

- Aged Care 7

- Apt Wealth 44

- Budgeting 32

- Business Financial Planning 8

- Divorce 5

- Estate Planning 14

- Ethical Investing 10

- Expat Financial Planning 20

- Expat UK 14

- Expat USA 16

- Financial Planning 141

- Financial Planning for Medical Professionals 6

- Financial Planning for Women 4

- High Net Worth Investment & Asset Management 35

- Home Loans 16

- Inheritance 5

- Insurance & Wealth Protection 12

- Latest Planning Articles 45

- Legal services 7

- Property Financial Planning 19

- Redundancy 4

- Retirement Planning 24

- SMSF Self Managed Superannuation Fund 6

- Succession Planning & Wealth Transfer 6

- Superannuation & Investments 34

- Uncategorized 9

CATEGORIES

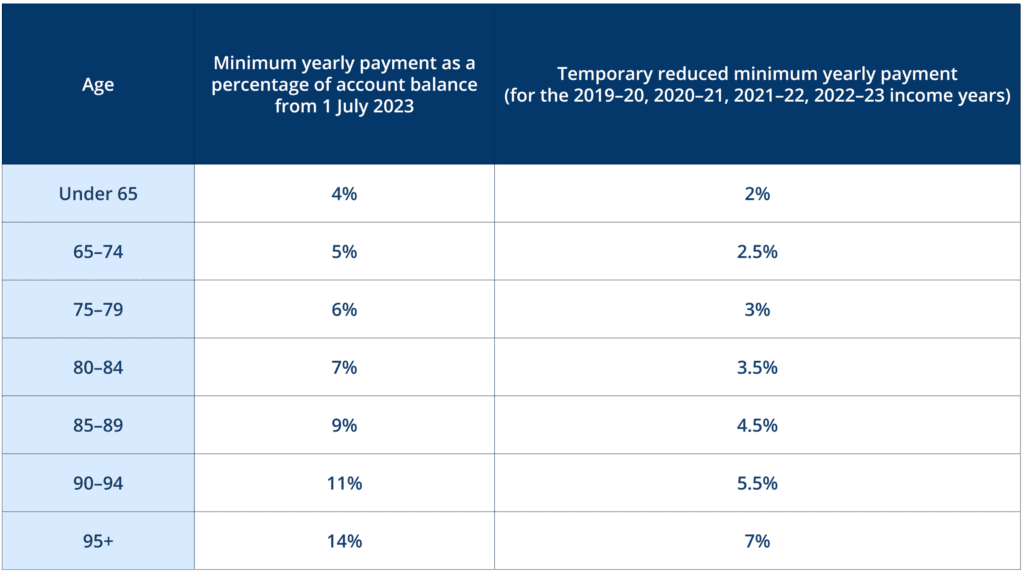

What Will Changes to Minimum Superannuation Income Streams Mean for You?

Andrew Dunbar

Jun 06, 2023

In March 2020, responding to the emerging COVID-19 pandemic, the Federal Government temporarily halved minimum pension drawdown amounts. This allowed pension members to withdraw less of their retirement savings and…

The superannuation transfer balance cap is changing. Here’s what you need to know

APT Admin

May 23, 2023

Summary The General Transfer Balance Cap (TBC) is set to be indexed to $1.9 million from 1 July 2023. Not everyone will receive the full increase. Your personal transfer balance…

Budget 2023: What you need to know

Andrew Dunbar

May 10, 2023

Summary Cost of living measures include energy bill relief for eligible households and small businesses, cheaper 60-day scripts for some medications, and a tripling of the bulk-billing incentive. In superannuation,…

ANZAC Day: Reflections on the Kokoda Track campaign

Andrew Dunbar

Apr 21, 2023

ANZAC Day is one of the most important days on the Australian calendar, a day when we remember and honour our servicemen and women who have helped to protect the…

Worried about how much you will need to retire? Five steps to increase your peace of mind

Andrew Dunbar

Apr 05, 2023

Semi-retirees worry about money more than most. In fact, as many as 1 in 5 Australians worry on a daily basis that they won’t have enough to retire. And it’s…

Strategies to minimise the impact of super cap changes

Andrew Dunbar

Mar 07, 2023

Recently, the Australian Government announced that it will be doubling the tax rates on superannuation earnings for those with AUD3M+ super balances in the 2025/26 tax year, which will see…

The top financial mistakes expats make – and how to avoid them

John Versace

Feb 27, 2023

With a new year upon us, many of us are thinking about our goals and plans for the year ahead. If this is you, you may be setting financial goals,…

Apt Wealth plans to deploy cash to small mid-caps, infrastructure

Staff Writer

Feb 20, 2023

This article was originally published by Citywire Australia. If you have a Citywire Australia account you can access the article here. With an overweight in cash, the wealth manager is…

Ask an Adviser: Which life and personal income insurers are the best at paying claims?

APT Admin

Jan 11, 2023

When it comes to insurance, we’ve all heard those ‘horror’ stories of claims not being paid, leaving the beneficiary in the lurch at an already difficult time. It’s a ubiquitous…

How to set meaningful New Year’s Resolutions

Andrew Dunbar

Jan 03, 2023

It’s that time of year again when many of us are thinking about our plans for the year ahead, and that means setting goals. With so many new year’s resolutions…

Why it’s critical to ensure your adult children have the right insurance in place

APT Admin

Dec 06, 2022

Underinsurance is a very real problem in Australia today, and it’s more prevalent amongst younger Australians. It’s not uncommon for people in their 20s, 30s, or even 40s to believe…