Financial Planning News and Insights

The latest news and views from Apt Wealth

From superannuation and retirement to investments and planning for life events and milestones, our team shares expert insights on common financial planning questions.

As always, please contact us for personalised advice that takes into account your circumstances and goals.

CATEGORIES

- All 543

- Aged Care 7

- Apt Wealth 44

- Budgeting 32

- Business Financial Planning 8

- Divorce 5

- Estate Planning 14

- Ethical Investing 10

- Expat Financial Planning 20

- Expat UK 14

- Expat USA 16

- Financial Planning 141

- Financial Planning for Medical Professionals 6

- Financial Planning for Women 4

- High Net Worth Investment & Asset Management 35

- Home Loans 16

- Inheritance 5

- Insurance & Wealth Protection 12

- Latest Planning Articles 45

- Legal services 7

- Property Financial Planning 19

- Redundancy 4

- Retirement Planning 24

- SMSF Self Managed Superannuation Fund 6

- Succession Planning & Wealth Transfer 6

- Superannuation & Investments 34

- Uncategorized 9

CATEGORIES

Three tips for better cash flow in mixed billing medical practice

Warner Leung

Oct 26, 2023

In medical practice, like any other business, cash flow is king. It’s the key to your ongoing stability and practice success. However, for medical practitioners who have mixed billing across…

Structuring your super to weather financial storms

Andrew Dunbar

Oct 11, 2023

In 2008, the Global Financial Crisis (GFC) had a significant impact on retirement savings across the globe, and many thought it was a once-in-a-generation event. But as we saw with…

Ask an Adviser: What is a private ancillary fund, and how can I set one up?

Andrew Dunbar

Sep 28, 2023

Many of us want to make an impact through philanthropy, and if it’s one of your goals, it should be part of your financial plan. Our advisers are often asked…

Top 100 Financial Advisers: Andrew Dunbar, Apt Wealth Partners

Staff Writer

Sep 25, 2023

This article was originally published in The Australian’s The Deal magazine. For Andrew Dunbar, the best parts of his job as a financial adviser are the human elements. A director…

Introducing Apt’s Comprehensive Financial Planning Services for UK Expats

APT Admin

Sep 12, 2023

Building on the continued success of its Expat Financial Planning Services, Apt Wealth Partners has recently ramped up its specialist service offering for UK expats. Integrating existing expat advice business…

Ask an Adviser: What is the Downsizer Contribution, and will it impact my Centrelink entitlements?

APT Admin

Sep 05, 2023

Australia’s downsizer contribution scheme has gained notable attention as a strategy to boost retirement savings. But what exactly is it, and how does it impact Centrelink payments? We asked Apt…

5 reasons to consider investing in Australian shares and listed investments while living in Dubai

Emily Lanciana

Aug 30, 2023

As an Australian living in Dubai, you may be wondering what your options are when it comes to investing any surplus cash. Of course, you have options to invest locally,…

Can I get US social security if I retire in Australia?

John Versace

Aug 17, 2023

As with most countries, there are restrictions on accessing social security outside the country, but they are not as onerous as you might think. US expats and Australians who have…

Want more confidence about your retirement? Here’s why a financial plan may be the answer.

Andrew Dunbar

Jul 19, 2023

Financial services firm Vanguard released their landmark How Australia Retires report recently, exploring Australia’s attitudes to retirement. In the wake of COVID-19, attitudes have shifted in many areas, but finances…

Cash Flow Discipline for Professional Service Partners

Preston Foster

Jul 10, 2023

As a new partner in a professional services firm, you will likely experience a significant change in income. This usually comes in the form of a large salary increase and…

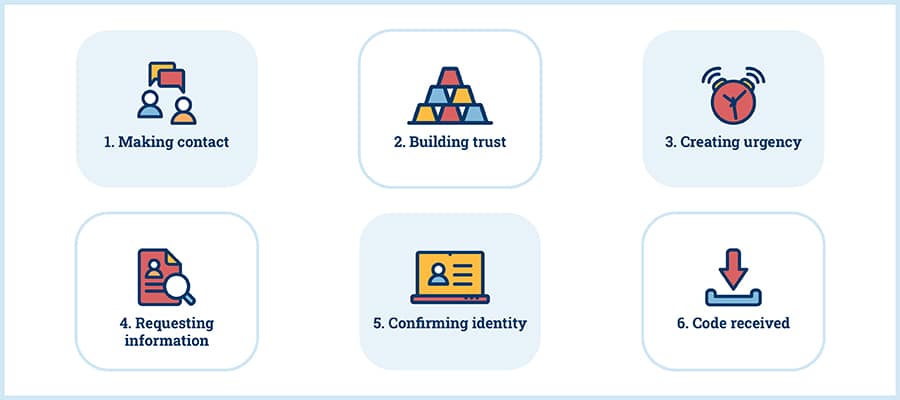

How to spot an impersonation scam

Mark Bardzinski

Jul 05, 2023

Impersonation scams, where a person pretends to be an authority, such as the police or an organisation (e.g. your bank or the Australian Tax Office) are on the rise. Unfortunately,…