Rent vs. buy: Is renting always a bad thing?

Matthew Dunbar

Dec 08, 2021

Trying to get on the property ladder today can feel like a losing game. Just as your deposit reaches a healthy point, prices continue to rise, and you need to…

Six ways you can support local businesses and communities this Christmas

Andrew Dunbar

Dec 02, 2021

During COVID-19, local businesses and organisations have faced a series of uphill battles, from lockdowns to travel restrictions and even staff shortages when reopening occurs. Unlike many large players, these…

What do changes to income protection mean for you?

APT Admin

Oct 28, 2021

The Australian Prudential Regulation Authority (APRA) recently reviewed personal income protection insurance to ensure it remains sustainable and affordable. As a result of this review, insurance policies issued after 1…

The True Value of Financial Advice: A Compass for your Life Decisions

Andrew Dunbar

Oct 12, 2021

Worrying about money and financial decisions is something that affects every family, regardless of financial position or socio-economic status. And it can be stressful; the decisions we make today will…

Tips to Manage Financial Stress

Andrew Dunbar

Sep 22, 2021

Regardless of financial position or socio-economic status, we’ve all worried about finances at one point or another. And if you are under financial pressure at the moment, you’re not alone….

Three tips to think differently about your financial decisions

Sean Moran

Sep 03, 2021

Ever notice yourself spending more time on trivial decisions than you do on the significant ones? You’re not alone. It’s often called ‘decision quicksand’, as these small decisions can seem…

4 financial planning myths debunked

Andrew Dunbar

Aug 04, 2021

Having worked in the industry for over 16 years, I see the benefits of financial planning every day. I witness first-hand how it changes people’s lives, protects and supports them…

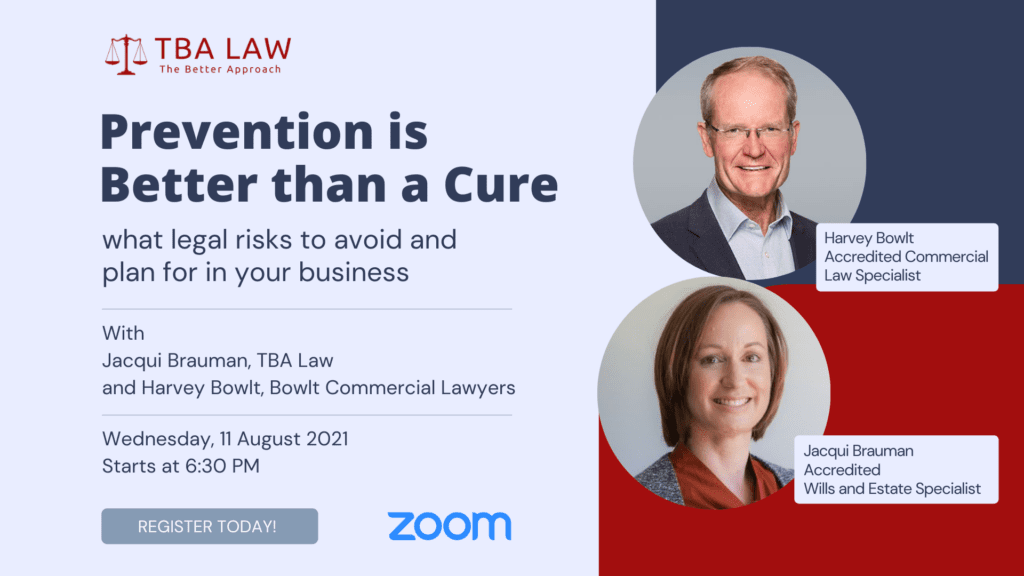

Prevention is better than a cure- webinar

Andrew Dunbar

Jul 30, 2021

Join Jacqui Brauman from TBA Law and Harvey Bowlt, from Bowlt Commercial Lawyers for an informative webinar outlining legal risks to avoid and plan for in business. The webinar will…

What is a personal finance coach and why do you need one?

Emily Lanciana

Jul 30, 2021

When you want to get fit, you’re likely to go to a personal trainer because you aren’t a fitness expert. Let’s face it; if you’re new to it, a gym…

Stay vigilant: Scams on the rise during the pandemic

Andrew Dunbar

Jun 29, 2021

It’s a sad reality today that many Australians are targeted by financial scams. It’s something we’ve talked about before, but in the wake of the COVID-19 pandemic, it’s clear that…

Are NFTs an investment?

Sarah Gonzales

Jun 07, 2021

You might have noticed some buzz lately around something called Non-Fungible Tokens or NFTs, which are essentially a digital certificate of ownership for digital assets, such as images and video….