Is FIRE the best approach to your money?

By Andrew Dunbar | 13/08/2019

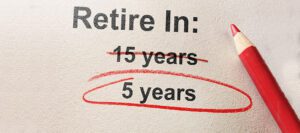

Lately, I've noticed increasing buzz around early retirement strategies and so I read with interest a recent article on a couple who retired in their early thirties. It's part of a growing movement known as FIRE (Financial Independence, Retire Early), whereby people focus aggressively on savings, with lofty goals and a plan to retire significantly earlier than usual.

On the surface, it does sound appealing – especially for those who have watched their parents work hard all their lives, struggling to pay off the family home then retiring too late to enjoy the good things in life. Retiring early may sound like the dream, but in my opinion, it's not the right approach for everyone.

At Apt, our philosophy is about living for today while planning for tomorrow, and while this approach might not see you retiring in your thirties or forties, it can allow you to achieve a level of financial independence that gives you freedom of choice later in your career.

Does a FIRE approach align with your goals?

If you are considering a FIRE strategy, before you get swept up planning your post-retirement life, it's important to consider whether the approach really aligns with your life goals, i.e. is it actually what you want? This might sound crazy – surely everyone wants to retire sooner right? – but the reality is that it is simply not suited to everyone.

Firstly, it'san approach that involves making tough lifestyle decisions, and those committed to the movement do forgo many of the good things in life, from social events to vacations. If travelling is important to you or you have an expensive hobby, for example, are you willing to give up these things today in service of your goal? You will need to be very single-minded and laser-focused on saving and this won't work for everyone because there are things you will miss out on.

Secondly, employment and career are linked to self-worth and even those who retire at a more conventional retirement age can find themselves feeling lonely and without purpose. It might sound like a great thing to not have to go to work anymore, but in actual fact it can led to boredom, emotional difficulties, a loss of identity and even feelings of social isolation. At work, we build social connections with our colleagues and all retirees can feel disconnected, but it can be worse for younger retirees because their peers are primarily still working.

What can you do instead?

Aiming for financial independence is always a good strategy and it can be done without the aggressive focus required to retire in your thirties or forties. Taking a longer-term view can enable you to have the best of both worlds – still enjoying life today and planning for tomorrow.

The first step is to be clear on your goals and what you want out of life, both financially and in terms of life experiences. This will help you understand where you should focus – maybe you want to buy a family home, go on the trip of a lifetime, or build a nest egg for the future. There are some simple things you can do today to start managing money better, and our9 tips for a healthy financial habits is a great place to start.

Deciding where and how to invest your money to reach your goals can be daunting. Although you can find a wealth of information online, building genuine financial literacy that will help you manage your investments and maximise returns can be tricky, and that's where expert help comes in. Often, financial planning is viewed as a service for retirement, but it is about so much more.

At Apt, we work with people across a variety of ages and life stages to build investment strategies that enable them to reach life goals – whether that be early retirement, getting married, having children, buying a house, or simply financial freedom. A financial planner should act as your money coach, supporting you in your goals and sharing their wealth of knowledge to manage your investments and help you make the most of your money.

It's not all about property either. Buying a home is a great strategy for some, but it's not a one size fits all – and that's where an expert can really look at your situation and goals and help you plan for your future – whatever you want that to look like.

If you have the right level of discipline, commitment and the right life goals, a FIRE strategy may just work for you, but if you want to enjoy your life today and plan for tomorrow there are other ways to reach your financial goals.

At the end of the day, if you aim to develop financial independence without giving up everything you love, it may take a little longer, but you may just find that you enjoy the journey – and even the destination – a little more.

General Advice Disclaimer

The information in this blog is provided by Apt Wealth Partners (AFSL 436121 ABN 49 159 583 847) and is of a general nature only. It may not be relevant to your personal needs, objectives or financial circumstances. The circumstances of each investor are different and you should seek advice from a financial planner who can consider if the strategies and products are right for you.