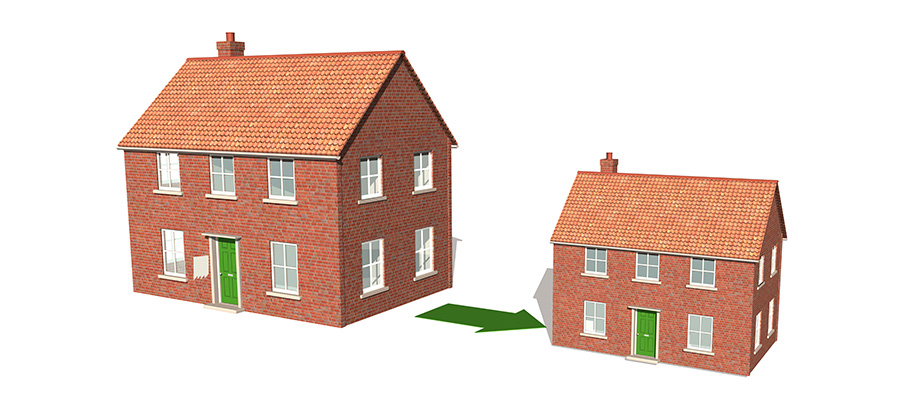

Is 2019 the right time to downsize?

By Andrew Dunbar | 04/03/2019

With experts tipping the property market to drop further in 2019, many people are speculating about their next property move. For retirees, this speculation is often around downsizing, and with the Federal Government's Downsizing Measure allowing eligible homeowners to boost their super with proceeds from the sale of the family home, it can be a great way to increase your retirement fund.

But is downsizing right for you? Many factors should come into consideration when making the downsizing decision, and while the market has a role, it's not necessarily the starring one. Lifestyle plays a big part, whether you are moving for a sea/tree change, to be closer to transport and services, or to live nearer to family – thinking about how you will live is just as important as where and when.

Here, we take a look at three key factors you should be considering when deciding if it is the right time for you to downsize:

What impact does the market have?

There is always speculation around the Australian property market, particularly in our major cities. It's important to remember, however, that if the market is dropping, your new house will be cheaper, but your current house is likely to attract a lower price as well. Making sure you can afford to buy something that suits you based on the value of your current home is, of course, critical, but as it's likely you'll buy and sell in the same market, it frequently ends up a zero-sum game.

I often hear people say they want to wait until the market increases, but you should also remember that the value of your home is not delivering you an income. Once you sell your home, you can free up money to be invested, so it’s not all about capital value.

Does it make sense financially?

Downsizing can be a great move to reduce or pay off debt, and a smaller place can attract lower maintenance costs and utility bills, so there are wins on a few fronts here. If you are moving closer to transport and services, such as hospitals, shops, etc, this can save on travel costs, and if you have two cars, you might be able to live with one in your new home.

The Downsizing Measure can help you boost your retirement savings too. But there are some additional costs that downsizers should take into account when doing the sums.

When it comes to selling, there are, of course, agent's fees and then there may be additional costs to get your home ready for sale, whether it be maintenance or even dressing/styling costs to make your property more attractive to the market. It can be worth doing these things, because they sometimes increase sale price, or at least increase interest in your property and reduce the time on market, but they are a cost you should prepare for.

And then when you buy, you'll need to pay stamp duty on your new home, and so this should come into financial considerations too.

Whether downsizing makes sense financially depends on your situation and your long and short-term goals, so it pays to get advice before making a decision.

Will it offer a better lifestyle?

Lifestyle is a key motivator in most property moves, and while that sea change may provide you with a better lifestyle, there is no denying that a smaller property will change how you live on a daily basis.

If you've spent a long time in your current home, you are probably well-accustomed to the space you have. On the positive side, reduced space will minimise the time you spend on cleaning and maintenance, but there are other considerations when it comes to living in a smaller space:

- If you are downsizing your home, you'll need to do the same with your possessions, as in a smaller space, storage can quickly become an issue. A good tip I once heard, is to pack unnecessary items a few months early and see which items you actually miss. These are the ones you'll need space for.

- If you are living with a partner, you'll be living in much closer quarters than before, and this can change the way you spend your downtime.

- You'll likely have less room for guests, and this may become an issue if you are moving far away from family and friends who will need to stay overnight to visit.

- If you have a hobby that requires space, gardening, for example, will the new property have the space to allow you to continue and how will it impact your lifestyle if you can't?

All-in-all, downsizing can be a great financial strategy, but it's important to remember that lifestyle plays a big part too. Retirement should be the time when you can do more of the things you enjoy in life, so your new home should facilitate this. It's always worthwhile to talk to your financial adviser to get an understanding of the big picture, that takes into account your financial and lifestyle goals.

General Advice warning

The information provided in this blog does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. Apt Wealth Partners (AFSL 436121 ABN 49 159 583 847) recommends that you obtain professional advice before making any decision in relation to your particular requirements or circumstances.