Tax-effective strategies to manage superannuation in FY 2025/26

Connie Yi

Jul 04, 2025

As we enter the 2025/26 financial year, superannuation remains one of the most powerful and tax-effective ways to build long-term wealth in Australia. The start of a new tax year…

Smart Tax Tips to Prepare for Financial Year End 2024/25

Andrew Dunbar

Jun 03, 2025

With 30 June fast approaching, now is the time to make sure your tax planning is on track. A little proactive preparation now can go a long way – helping…

Proposed changes to superannuation taxes before Parliament

Andrew Dunbar

May 20, 2025

We’ve previously written about the government proposal to levy additional tax for those with $3M+ super balances, which had been awaiting parliamentary approval. With Labor winning a majority in the…

Closing the retirement savings gap for women

Tracey Pace

May 09, 2025

In Australia today, women are still retiring with around 30% less superannuation than their male counterparts. And while some positive systemic changes are taking place, such as the government introducing…

What should you be considering in your financial plans for 2025? Here’s our guide for every age and career stage

Andrew Dunbar

Jan 06, 2025

When it comes to financial planning, many Australians automatically think of retirement. However, financial planning is about setting you up for success at every age. And in most cases, the…

Investing in 2024

Andrew Dunbar

Jan 08, 2024

At the start of the new year, many of us are thinking about our investment portfolios and whether we need to make any changes for the year ahead. With global…

Ask an Adviser: Do estate taxes apply to superannuation?

APT Admin

Nov 07, 2023

Estate planning can be complex, particularly when it comes to the tax implications. Our advisers are often asked whether estate taxes apply to superannuation, so we asked Compliance Manager Tammy…

Structuring your super to weather financial storms

Andrew Dunbar

Oct 11, 2023

In 2008, the Global Financial Crisis (GFC) had a significant impact on retirement savings across the globe, and many thought it was a once-in-a-generation event. But as we saw with…

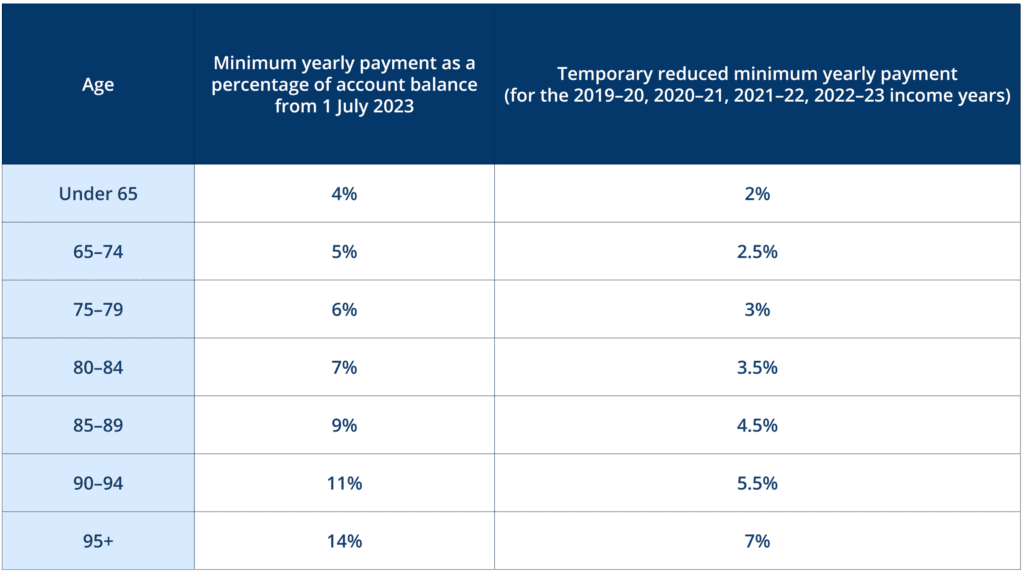

What Will Changes to Minimum Superannuation Income Streams Mean for You?

Andrew Dunbar

Jun 06, 2023

In March 2020, responding to the emerging COVID-19 pandemic, the Federal Government temporarily halved minimum pension drawdown amounts. This allowed pension members to withdraw less of their retirement savings and…

The superannuation transfer balance cap is changing. Here’s what you need to know

APT Admin

May 23, 2023

Summary The General Transfer Balance Cap (TBC) is set to be indexed to $1.9 million from 1 July 2023. Not everyone will receive the full increase. Your personal transfer balance…

Strategies to minimise the impact of super cap changes

Andrew Dunbar

Mar 07, 2023

Recently, the Australian Government announced that it will be doubling the tax rates on superannuation earnings for those with AUD3M+ super balances in the 2025/26 tax year, which will see…

Ask an Adviser: What will change with superannuation from 1 July 2022?

Rhett Pudney

Jun 28, 2022

Earlier this year, The Treasury Laws Amendment (Enhancing Superannuation for Australians and Helping Australian Businesses Invest) passed both houses of parliament and will come into effect on 1 July 2022. We asked…