What does the new Aged Care Act mean for me?

By Lisa Haley | 11/02/2025

Australia is on the brink of a significant transformation in aged care, with the introduction of the Aged Care Act 2024, set to come into effect on 1 July 2025. This landmark legislation marks a turning point for the sector, promising to redefine aged care in Australia.

But what does it mean for you? If you’re planning for your own or a loved one’s aged care, it’s important to understand how the Act will change the landscape.

Why was the new Aged Care Act introduced?

The new Act has come from a comprehensive review and aims to address long-standing issues in the embattled sector. From the all-important need for quality care to addressing the commercial realities for providers, it is designed to transform the sector on several fronts.

What will change under the new Aged Care Act?

The new Act outlines significant reforms across the sector, many designed to increase oversight, transparency and provider accountability to provide consistent quality and care – all incredibly important areas that need addressing.

The key umbrella change is that the sector will move from a provider-based model to a people- and needs-centred one. This means that access to services and funding will change based on individual needs. And while this approach may be a positive step, it’s important to understand how funding changes could impact you.

Why is aged care funding changing under the new Act?

More than 50% of aged care providers are running at a loss, and with Australia’s ageing population, it’s not sustainable. By 2066, 4.5 million Australians will be aged 65 or over, and to meet increasing demand while ensuring the provision of quality care, the aged care sector must be:

- attractive for private providers to invest in

- able to attract and retain skilled and experienced workers

- financially viable to avoid cost-cutting measures or corner-cutting that can result in decreased quality of care and resident neglect.

How is funding changing under the new Aged Care Act?

Under the new Act, around 50% of Australians are expected to pay more for aged care. However, the taxpayer will continue to fund the majority – 89% for home care (down from 95%) and 73% for residential care (down from 76%).

The increase in funding will be introduced through a few measures, including:

- more means testing

- raising the lifetime cap

- returning to a retention amount system (last seen in 2014) whereby those buying a room in an aged care facility will have a small portion retained to contribute to costs.

How will home care change?

The home care system is more affordable for the taxpayer and often aligns with family and individual preferences, so this system will come to the fore with gradual improvements to be rolled out.

Presently, there are four levels of home care packages, plus a low-needs Commonwealth Home Support Programme (CHSP). Much of the funding in these programs is currently allocated to a person but remains unspent. While this funding can be carried forward, it can’t be reallocated to someone else, resulting in long wait lists for home care packages.

Under the new Act, there will be 10 package levels, eight for ongoing care and two for rehab and palliative care needs. This restructure is designed to better meet individual needs and address funding issues, with unspent amounts lost quarterly to allow for reallocation to others who need it.

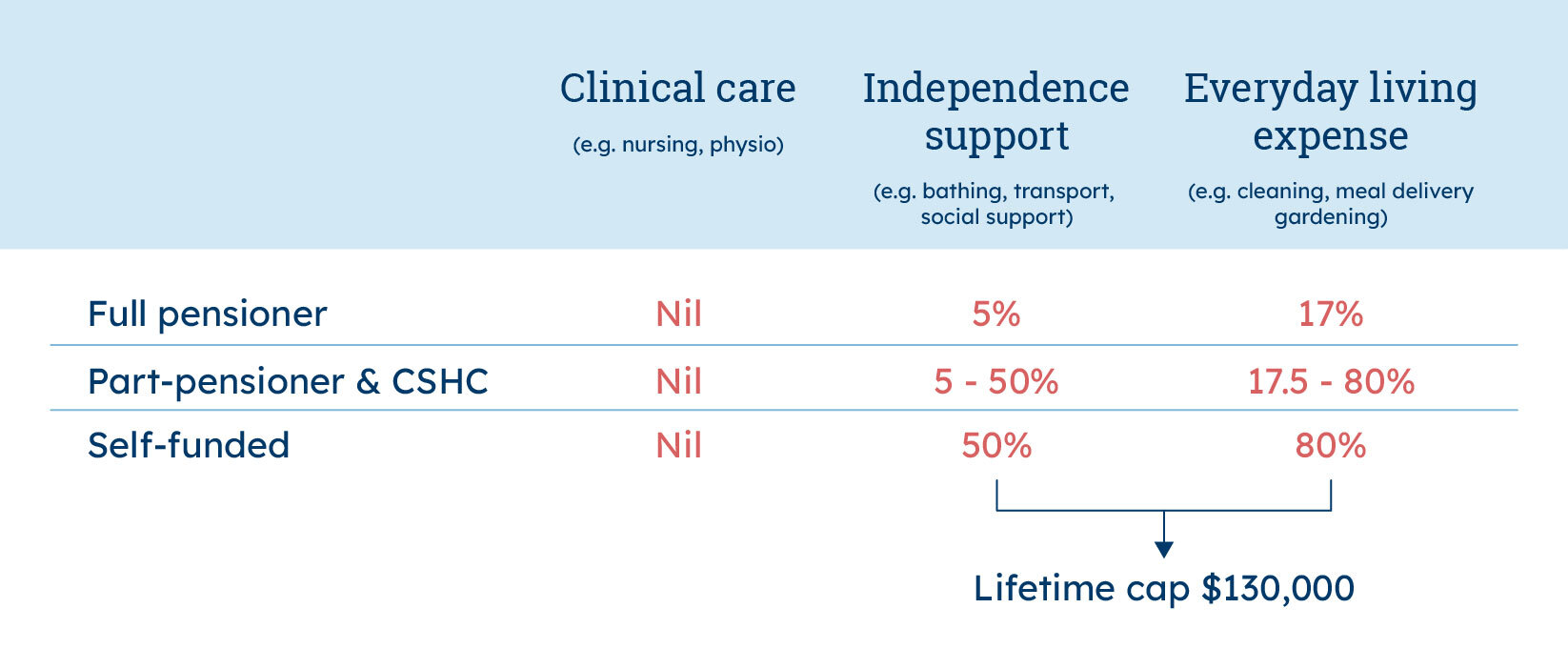

From 1 July 2025, the new co-contribution for home care will be a percentage of the cost rather than a flat fee.

For example, a part-pensioner who needs help with bathing each morning, costing $100, will pay $5, with $95 covered by the packaged budget. There will be specific lists of items and maximum fees to better cap the costs, and a maximum of 10% of the budget is allowed for admin costs.

What if I am already on a home care package before 1 July 2025?

There will be some grandfathering applying for those who qualified for a home package before 12/9/24 whereby you will have your fees calculated still on favourable older-style thresholds, so lower fees charged, and will be able to carry forward unspent amounts as per the current rules.

Note that:

- Even if you applied and are stuck on a waiting list, or not actively used a package allocated to you, you may still qualify as a pre-12/9/24 client

- If you ever applied for a package, or had home help after some surgery in the distant past - even if you have not been using the services recently - you may find that you STILL qualify for grand-fathering – so if in doubt call My Aged Care on 1800 200 422 and have them look up your name to see if you have registered and qualify for the lower fees

- The CHSP or Commonwealth Home Support Program does not qualify you for grandfathering – only the full Home Care Package system. Call the phone number above if unsure.

How will residential care funding change?

One key change in this sector is around the Refundable Accommodation Deposit (RAD). Currently, your RAD is 100% refundable (e.g. if you pay $500K for a room, you get $500K back). Under the new rules, a retention amount model will come into play at 2% per annum and up to a maximum of 10% per annum at five years of care. The facility will retain a small amount each month to supplement your other fees, and return the balance at exit.

Of course, as with many calculations, the application is a little more technical than that, and it is worked out on a ‘diminishing basis monthly’ which simply means that rather than $500,000 becoming $490,000 after 1 year, you receive $490,090 back as the 2% p.a. is applied to the RAD value as it decreases each month. So technically if you left care after 5 years exactly you would receive back a bit more than $450,000 (having a little under $10,000 a year deducted for maximum 5 years).

If you rent your room rather than buy it with a lump sum, the key change is that your Daily Accommodation Payment (DAP) will be indexed to CPI under the new Act.

Daily residential care fees will also be impacted. With increased means testing and changes to the lifetime cap, some of the impacts to be aware of are:

- Fees will likely be higher for those with the means to pay (noting that clinical care remains fully covered by the taxpayer).

- Everyday living expenses, which you paid for at home anyway, may now be charged up to $12.55 per day if you exceed an assets/income test.

- The lifetime cap on means-tested fees (paying for non-clinical care) will rise from $82,000 to $130,000 (and cut out at 4 years, whichever comes first)

However, the maximum daily means-tested fee will be $101.16 per day for those with high assets/income, and it’s worth noting this is better than the current system where people can pay over $400 per day.

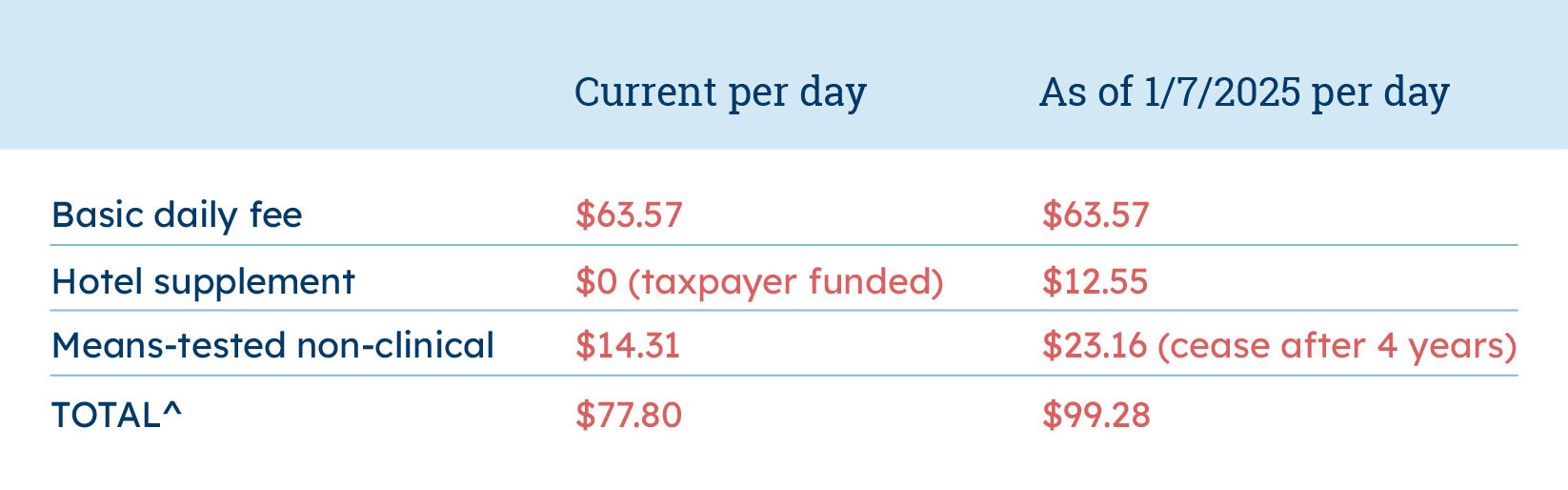

For example, eighty-year-old Ethel moves into care with assets of a house worth $800K and $400K cash in the bank. She receives an Age Pension of $22K per annum.

Currently, she pays $77.80 daily, broken down into a basic daily fee of $63.57, a means-tested fee for non-clinical care of $14.31 and a hotel supplement currently covered by the taxpayer.

After 1 July 2025, she will pay $99.28 daily, with $63.57 basic daily fees (no change), a means-tested fee for non-clinical care of $23.16 and a hotel supplement of $12.55. It’s worth noting that her means-tested fee for non-clinical care will cease after four years.

^ Plus fees for the room (RAD/DAP or RAC/DAC) and additional services fees (alcohol, entertainment, newspapers, etc.)

What steps should I take before the new Aged Care Act is in place?

As mentioned above, if you are considering a home care package, get in the queue now. If you are currently in or considering residential care for yourself or a loved one, contact an Apt adviser. We can assess your current circumstances and advise you on the best strategy, providing guidance and support as you navigate Australia’s aged care maze.

General Advice warning

The information provided in this blog does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. Apt Wealth Partners (AFSL and ACL 436121 ABN 49 159 583 847) and Apt Wealth Home Loans (powered by Smartline ACL 385325) recommends that you obtain professional advice before making any decision in relation to your particular requirements or circumstances.